HORTER INVESTMENT MANAGEMENT, LLC

Weekly Commentary horterinvestment.com June 4, 2018

The US economy suddenly looks like it’s unstoppable

In the face of persistent fears that the world could be facing a trade war and a synchronized slowdown, the U.S. economy enters June with a good deal of momentum.

Friday’s data provided convincing evidence that domestic growth remains intact even if other developed economies are slowing. A better-than-expected nonfarm payrolls report coupled with a convincing uptick in manufacturing and construction activity showed that the second half approaches with a tail wind blowing.

“The fundamentals all look very solid right now,” said Gus Faucher, chief economist at PNC. “You’ve got job growth and wage gains that are supporting consumer spending, and tax cuts as well. There’s a little bit of a drag from higher energy prices, but the positives far outweigh that. Business incentives are in good shape.”

The day started off with the payrolls report showing a gain of 223,000 in May, well above market expectations of 188,000, and the unemployment rate hitting an 18-year low of 3.8 percent.

Then, the ISM manufacturing index registered a 58.7 reading — representing the percentage of businesses that report expanding conditions — that also topped Wall Street estimates. Finally, the construction spending report showed a monthly gain of 1.8 percent, a full point higher than expectations.

Put together, the data helped fuel expectations that first-quarter growth of 2.2 percent will be the low-water point of 2018.

Trump and Allies Set for Showdown Over Trade

President Donald Trump is headed for a showdown with America’s allies at a Group of Seven summit this week in Quebec, with the European Union and Canada threatening retaliatory measures unless he reverses course on new steel and aluminum levies.

China, while open to talks to resolve the dispute, is warning it will withdraw commitments it made on trade if the president carries out a separate threat to impose tariffs on the Asian country. While China doesn’t want an escalation in trade tensions, it will defend its core interests, according to a commentary published Monday by the state-run Economic Daily.

Trump changes his mind often enough that U.S. allies and rivals alike hope he’ll do just that on tariffs in the next few days. An all-out trade war may become unavoidable if he doesn’t. “We still have a few days to avoid an escalation. We still have a few days to take the necessary steps to avoid a trade war between the EU and the U.S.,” French Finance Minister Bruno Le Maire said after a meeting of G-7 finance ministers and central bank governors in Whistler, British Columbia.

The White House appeared unfazed by threats from allies. Top economic adviser Larry Kudlow said the blame for any escalation lies with the U.S.’s trading partners. Trump doubled down on that message Monday morning, tweeting that China and Canada have unacceptable barriers against agricultural imports.

“The U.S. has made such bad trade deals over so many years that we can only WIN,” Trump tweeted. Investors in Asia appeared little rattled by the talk of war, with stock markets in Japan, China, Australia and South Korea all up in trading on Monday.

The metal tariffs imposed on the European Union and Canada are the latest escalation by the U.S. on the trade front that has roiled financial markets for months and prompted the International Monetary Fund to warn of a trade war that could undermine the broadest global upswing in years.

Taking a comprehensive look at the overall current stock market

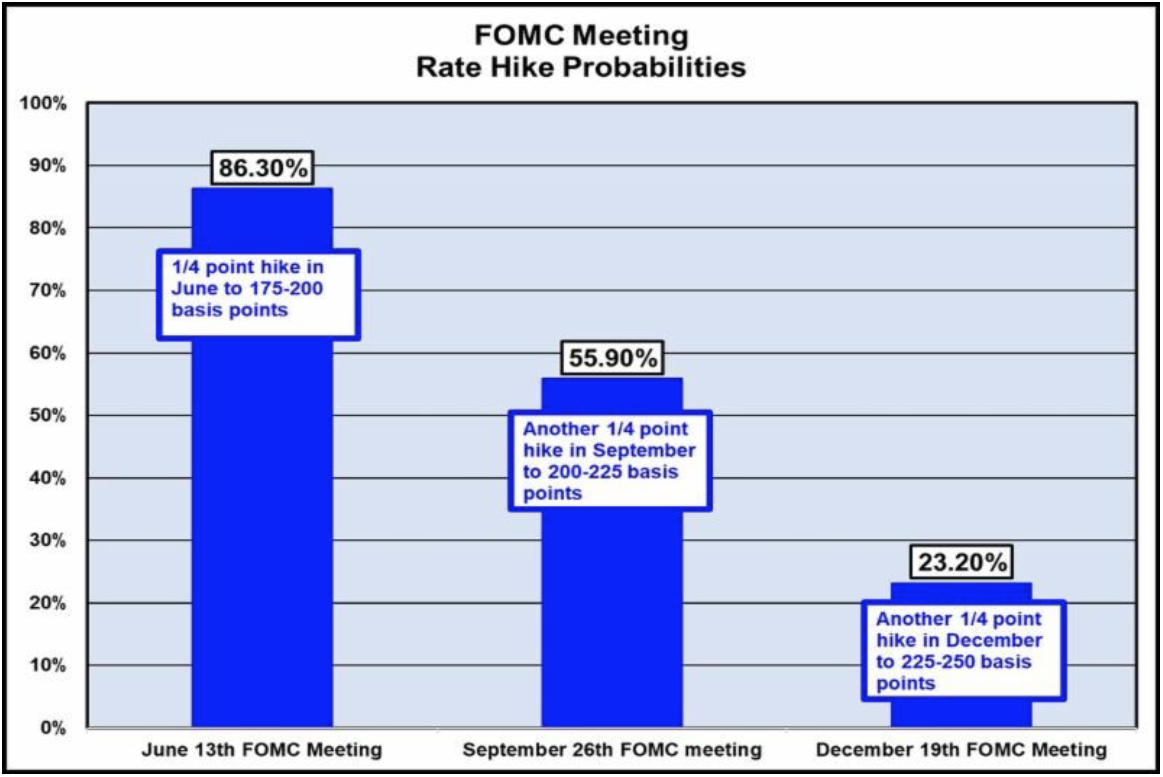

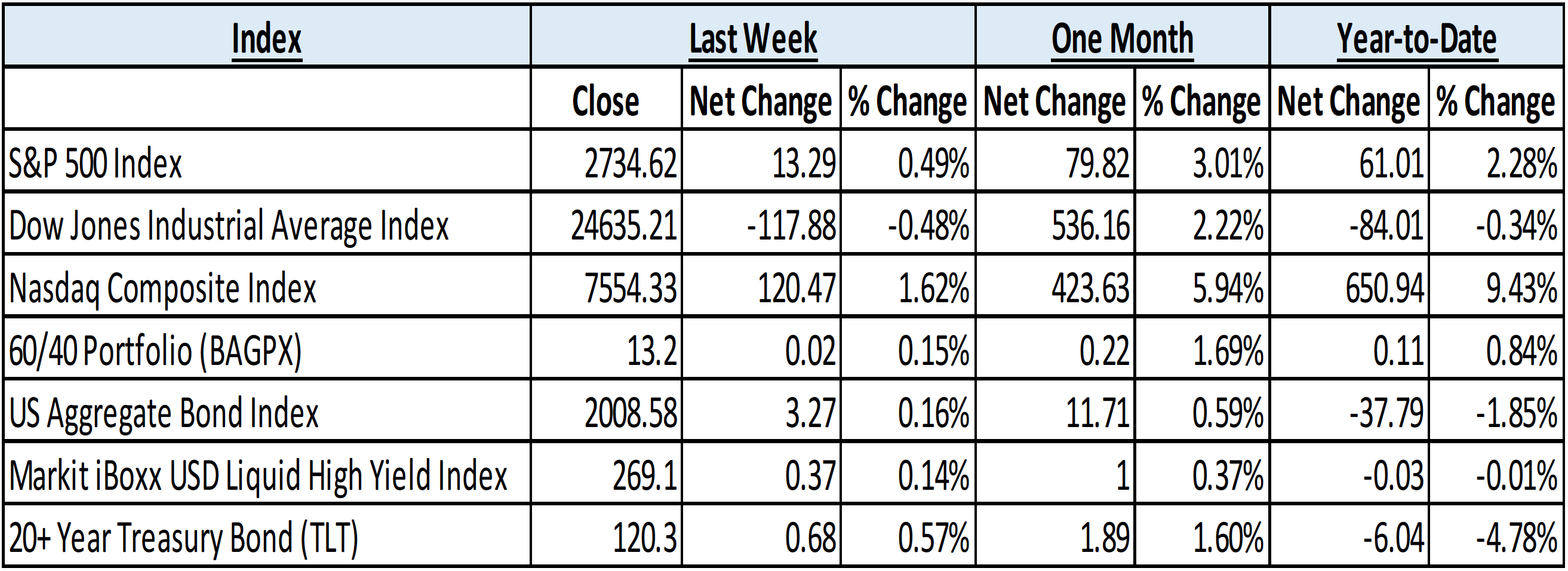

Taking a comprehensive look at the overall current stock market, you can see the chart below representing eight major in-dices and their returns through the week ending June 4, 2018. In a truly diversified portfolio, the portfolio’s total return is determined by the performance of all of the individual positions in combination – not individually.

So, understanding the combined overall performance of the indices below, simply average the 7 indices to get a better overall picture of the market. The combined average of all 7 indices is 0.80% year to date.

Data Source: Investors FastTrack, Yahoo Finance

Past performance is not a guarantee of future results. This Update is limited to the dissemination of general information pertaining to its investment advisory services and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock and bond markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice. Horter has experienced periods of underperformance in the past and may also in the future. The returns represented herein are total return inclusive of reinvesting all interest and dividends.

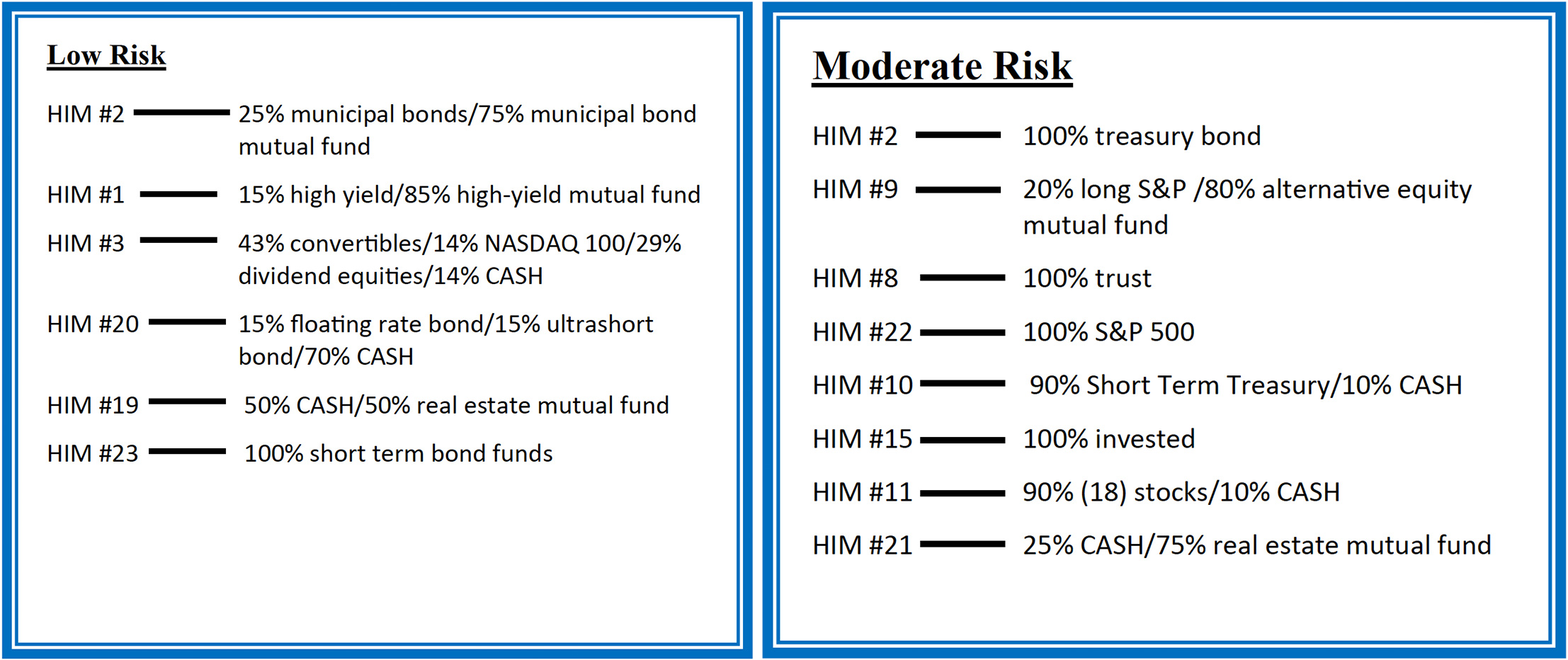

The above equity, bond and cash weightings are targets and may not be the exact current weightings in any particular client account. Specifically, there may be cases where accounts hold higher cash levels than stated in these target weightings. This is usually to accommodate account level activity. Furthermore, some variable annuity and variable universal life accounts may not be able to purchase the exact weightings that we are indicating above due to specific product restrictions, limitations, riders, etc. Please refer to your client accounts for more specifics or call your Horter Investment Management, LLC at (513) 984-9933.

Investment advisory services offered through Horter Investment Management, LLC, a SEC-Registered Investment Advisor. Horter Investment Management does not provide legal or tax advice. Investment Advisor Representatives of Horter Investment Management may only conduct business with residents of the states and jurisdictions in which they are properly registered or exempt from registration requirements. Insurance and annuity products are sold separately through Horter Financial Strategies, LLC. Securities transactions for Horter Investment Management clients are placed through TCA by E*TRADE, TD Ameritrade and Nationwide Advisory Solutions.

For additional information about Horter Investment Management, LLC, including fees and services, send for our disclosure statement as set forth on Form ADV from Horter Investment Management, LLC using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

Dow Jones – Week Ending

WEEKLY MARKET SUMMARY

Global Equities: The holiday-shortened week brought mixed results for the three major US stock indices, beginning with Italian political news roiling markets as concerns were raised by populist parties attempted to form a new government with a renewed anti-European Union sentiment. Italian sovereign debt yields soared on Tuesday, and threatened contagion to the European financial system and beyond. US markets were assuaged on Wednesday, but it is not likely the end of the Italian situation. The Nasdaq Composite, again, led the major US equity indices, with a 1.4% gain for the week, while the S&P 500 gained nearly .4%. The Dow Jones Indus-trial Average lagged, losing .6% for the week. The Energy sector regained its leading status for this week, while Financials and its SPDR Select Sector ETF (XLF) lost over 1.3%. Emerging Market equities and the iShares MSCI Emerging Markets Index ETF (EEM) lost almost .3%, while International Developed Markets and the iShares MSCI EAFE Index Fund ETF ended down around .4%.

Fixed Income: The yield on the US 10-Year Treasury Note fell sharply at the beginning of the week to under 2.8%, as the Italian political issue caused a flight to safety. Solid US economic releases helped yields bounce back to close only slightly lower than the prior week at 2.9%. High-yield debt funds recorded slight outflows for the week, and once again, their corresponding spreads over risk-free securities widened slightly due to not dropping as quickly as Treasuries. The iShares IBoxx High-yield Corporate Bond ETF (HYG) was virtually unchanged for the week on a total return basis.

Commodities: A strange week for oil prices saw the spread be-tween the Brent Crude benchmark and the American West Texas Intermediate (WTI) widen to multi-year highs of over $10 per bar-rel. As US production is at or near all-time high levels, inadequate infrastructure is causing disruptions and limiting the ability to help offset global supply constraints from OPEC and Venezuela. As such, Brent Crude ended the week up slightly near $76.74 per barrel, while the WTI price was off greater than 3%, to around $65.78 per barrel. Natural Gas prices rose again this week, to $2.97/MMBtu.

WEEKLY ECONOMIC SUMMARY

Employment Situation: Nonfarm payrolls increased more than the consensus estimate and outside of the consensus range at 223,000 versus a range of 155,000 to 220,000 for May. The unemployment rate fell to an 18-year low of 3.8%, signaling continued strength in the labor market. The leading sectors for job growth were retail with 31,000, health-care with 29,000, construction with 25,000, and professional/technical services with 23,000 jobs added. The employment growth is positive for the economic outlook, though, obviously unsustainable at the current demographic levels.

1st Quarter GDP: The most recent GDP estimate for the 1st quarter has been revised lower to 2.2% annualized versus the 2.3% preliminary reading. Culprits for the lower revision include a large decrease in inventory growth, weaker consumer spending, and a slower rise in exports than the first estimates. Lower corporate taxes paid were explicitly evident in the numbers, as well as implicit in the higher revision of business fixed investment. The small relative change to the GDP estimate matters little, provided a bounce back in consumer spending is evident in the 2nd quarter GDP release.

Personal Income & Outlays: On Thursday, a positive sign for 2nd quarter GDP was released when consumer spending for April came in higher than consensus at .6% month-on-month (MoM) with the estimate for the prior figure in March revised higher to .5%. Personal income grew in-line with the median consensus estimate of .3% MoM, while Personal Consumption Expenditures (PCE), a measure of inflation, came in at the low end of the consensus range, at 2% year-on-year (YoY). Core PCE, the favorite measure of inflation for the Federal Reserve (Fed) which excludes food & energy, was in line with consensus and not indicative of accelerating inflation at 1.8% YoY.

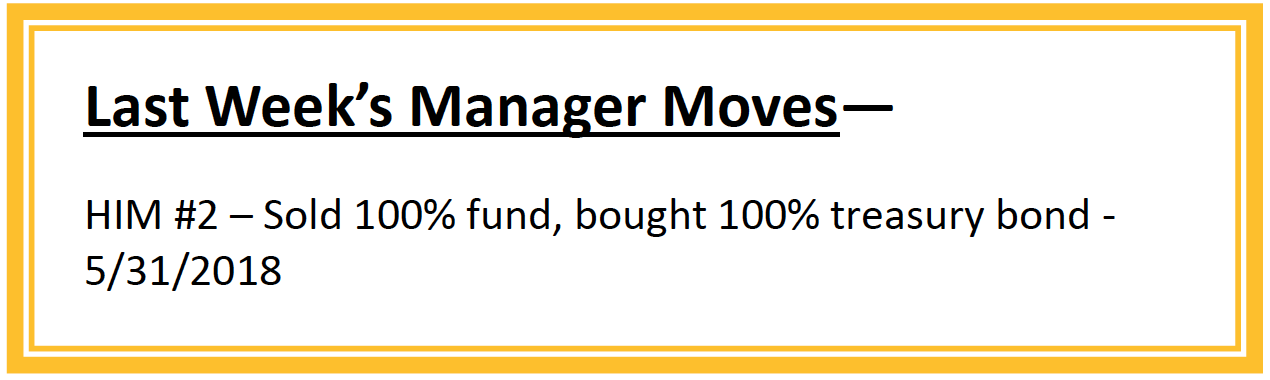

Current Model Allocations

Summary

In utilizing an approach that seeks to limit volatility, it is important to keep perspective of the activity in multiple asset classes. We seek to achieve superior risk-adjusted returns over a full market cycle to a traditional 60% equities / 40% bonds asset allocation. We do this by implementing global mandates of several tactical managers within different risk buckets. For those investors who are unwilling to stomach anything more than minimal downside risk, our goal is to provide a satisfying return over a full market cycle compared to the Barclays Aggregate Bond Index. At Horter Investment Management we realize how confusing the financial markets can be. It is important to keep our clients up to date on what it all means, especially with how it relates to our private wealth managers and their models. We are now in year nine of the most recent bull market, one of

the longest bull markets in U.S. history. At this late stage of the market cycle, it is extremely common for hedged managers to underperform, as they are seeking to limit risk. While none of us know when a market correction will come, even though the movement and volatility sure are starting to act like a correction, our managers have been hired based on our belief that they can accomplish a satisfying return over a full market cycle, —while limiting risk in comparison to a traditional asset allocation approach. At Horter we continue to monitor all of the markets and how our managers are actively managing their portfolios. We remind you there are opportunities to consider with all of our managers. Hopefully this recent market commentary is helpful and thanks for your continued trust and loyalty.