HORTER INVESTMENT MANAGEMENT, LLC

Weekly Commentary horterinvestment.com December 3, 2018

A $9 trillion corporate debt bomb is ‘bubbling’ in the US economy

At first glance, it looks like a $9 trillion time bomb is ready to detonate, a corporate debt load that has escalated thanks to easy borrowing terms and a seemingly endless thirst from investors.

On Wall Street, though, hopes are fairly high that it’s a manageable problem, at least for the next year or two.

The resolution is critical for financial markets under fire. Stocks are floundering, credit spreads are blowing out and concern is building that a combination of higher interest rates on all that debt will begin to weigh meaningfully on corporate profit margins.

“There is angst in the marketplace. It’s not misplaced at all,” said Michael Temple, director of credit research at asset manager Amundi Pioneer. “But are we at that moment where this thing blows sky high? I would think that we’re not there yet. That’s not to say that we don’t get there at some point over the next 12 to 18 months as rates continue to move higher.”

Essentially, the situation can break in two ways: a good-news case where companies can manage their debt as the economy stabilizes and interest rates stay in check, and the other where the economy decelerates, rates keep heading up and it’s no longer so easy to keep rolling that debt over.

There’s one worrying trend where companies on the edge of the investment-grade universe lose their standing and turn into high-yield or junk, sending rates — and defaults — significantly higher. And there’s a more positive case where the U.S. continues to out-perform the rest of the world and corporate debt problems are limited to overseas and specific companies that aren’t systemically important.

Fed warns that a ‘particularly large’ plunge in market prices is possible if risks materialize

The Federal Reserve issued a cautionary note Wednesday about risks to financial stability, saying trade tensions, geopolitical uncertainty and a buildup in corporate debt among firms with weak balance sheets pose strong threats.

In a lengthy first-time report on the banking system and corporate and business debt, the Fed warned of “generally elevated” asset prices that “appear high relative to their historical ranges.”

In addition, the central bank said ongoing trade tensions, which are running high between the U.S. and China, coupled with an uncertain geopolitical environment could combine with the high asset prices to provide a notable shock.

“An escalation in trade tensions, geopolitical uncertainty, or other adverse shocks could lead to a decline in investor appetite for risks in general,” the report said. “The resulting drop in asset prices might be particularly large, given that valuations appear elevated relative to historical levels.”

The drop in asset prices would make it more difficult for companies to get funding, “putting pressure on a sector where leverage is already high,” the report said.

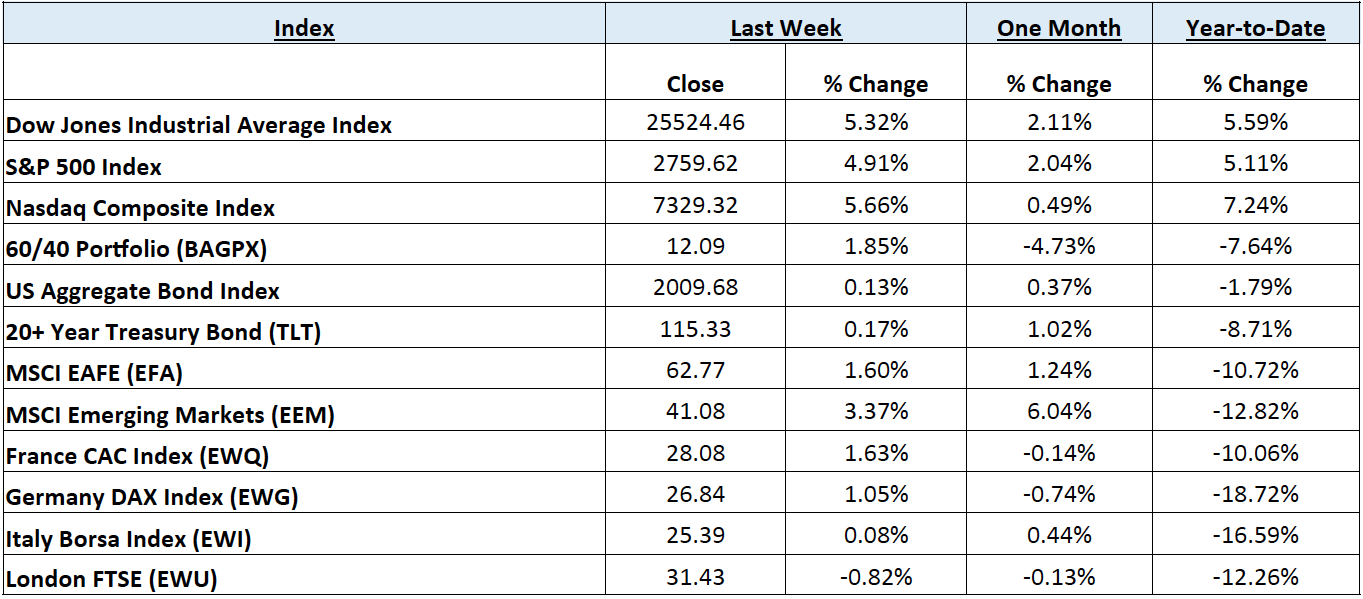

Taking a comprehensive look at the overall current stock market

Taking a comprehensive look at the overall current stock market, you can see the chart below representing eight major indices and their returns through the week ending November 30, 2018. In a truly diversified portfolio, the portfolio’s total return is determined by the performance of all of the individual positions in combination – not individually.

So, understanding the combined overall performance of the indices below, simply average the 12 indices to get a better overall picture of the market. The combined average of all 12 indices is -6.78% year to date.

Data Source: Investors FastTrack, Yahoo Finance, Investopedia

Past performance is not a guarantee of future results. This Update is limited to the dissemination of general information pertaining to its investment advisory services and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock and bond markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice. Horter has experienced periods of underperformance in the past and may also in the future. The returns represented herein are total return inclusive of reinvesting all interest and dividends.

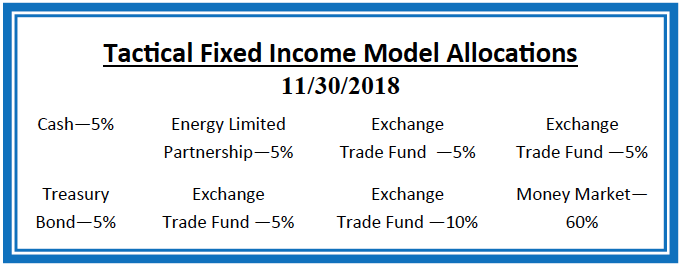

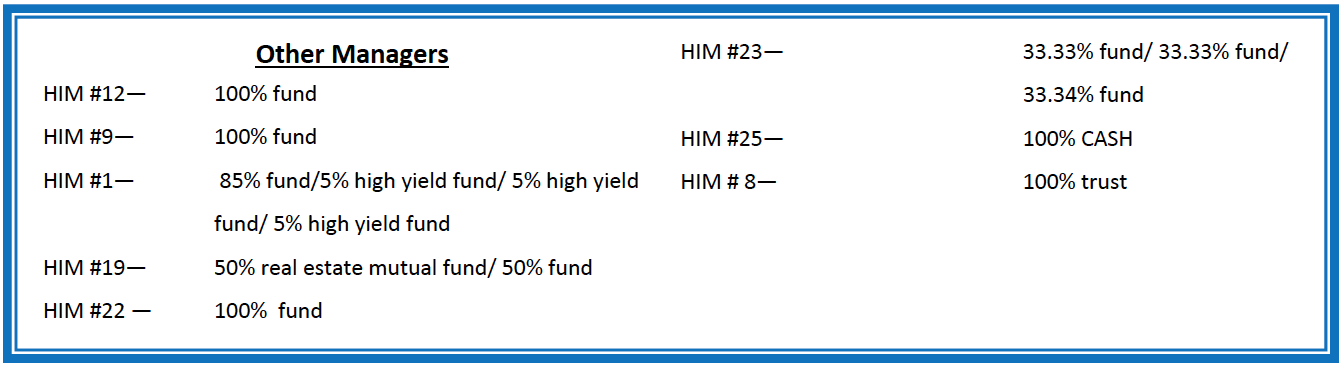

The above equity, bond and cash weightings are targets and may not be the exact current weightings in any particular client account. Specifically, there may be cases where accounts hold higher cash levels than stated in these target weightings. This is usually to accommodate account level activity. Furthermore, some variable annuity and variable universal life accounts may not be able to purchase the exact weightings that we are indicating above due to specific product restrictions, limitations, riders, etc. Please refer to your client accounts for more specifics or call your Horter Investment Management, LLC at (513) 984-9933.

Investment advisory services offered through Horter Investment Management, LLC, a SEC-Registered Investment Advisor. Horter Investment Management does not provide legal or tax advice. Investment Advisor Representatives of Horter Investment Management may only conduct business with residents of the states and jurisdictions in which they are properly registered or exempt from registration requirements. Insurance and annuity products are sold separately through Horter Financial Strategies, LLC. Securities transactions for Horter Investment Management clients are placed through TCA by E*TRADE, TD Ameritrade and Nationwide Advisory Solutions.

For additional information about Horter Investment Management, LLC, including fees and services, send for our disclosure statement as set forth on Form ADV from Horter Investment Management, LLC using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

Dow Jones – Week Ending

WEEKLY MARKET SUMMARY

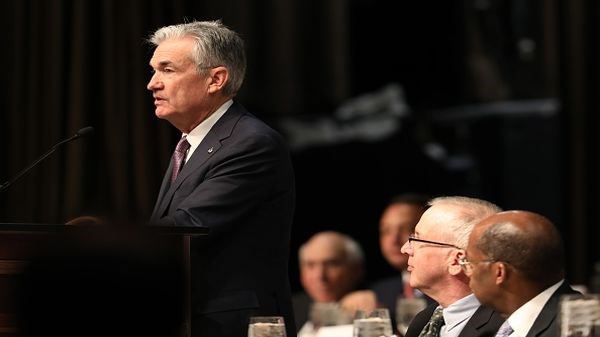

Global Equities: Global stock markets ended the week with gains after dovish comments from Federal Reserve Chairman Jerome Powell ignited a mid-week surge. Wednesday’s gains for the S&P 500 and Dow Jones Industrial Average were the best single-day performance since March. The euphoria was short-lived as nervous traders quickly turned their attention to the weekend’s G20 meeting and speculation over whether talks between President Trump and Chinese President Xi Jinping will yield the framework of a trade agreement, or further escalation. The S&P 500 closed out the week almost 5% higher while international developed markets, as measured by the iShares MSCI EAFE ETF (EFA) rose roughly 1.5% and emerging markets closed around 3% higher, as measured by the iShares MSCI Emerging Markets ETF (EEM).

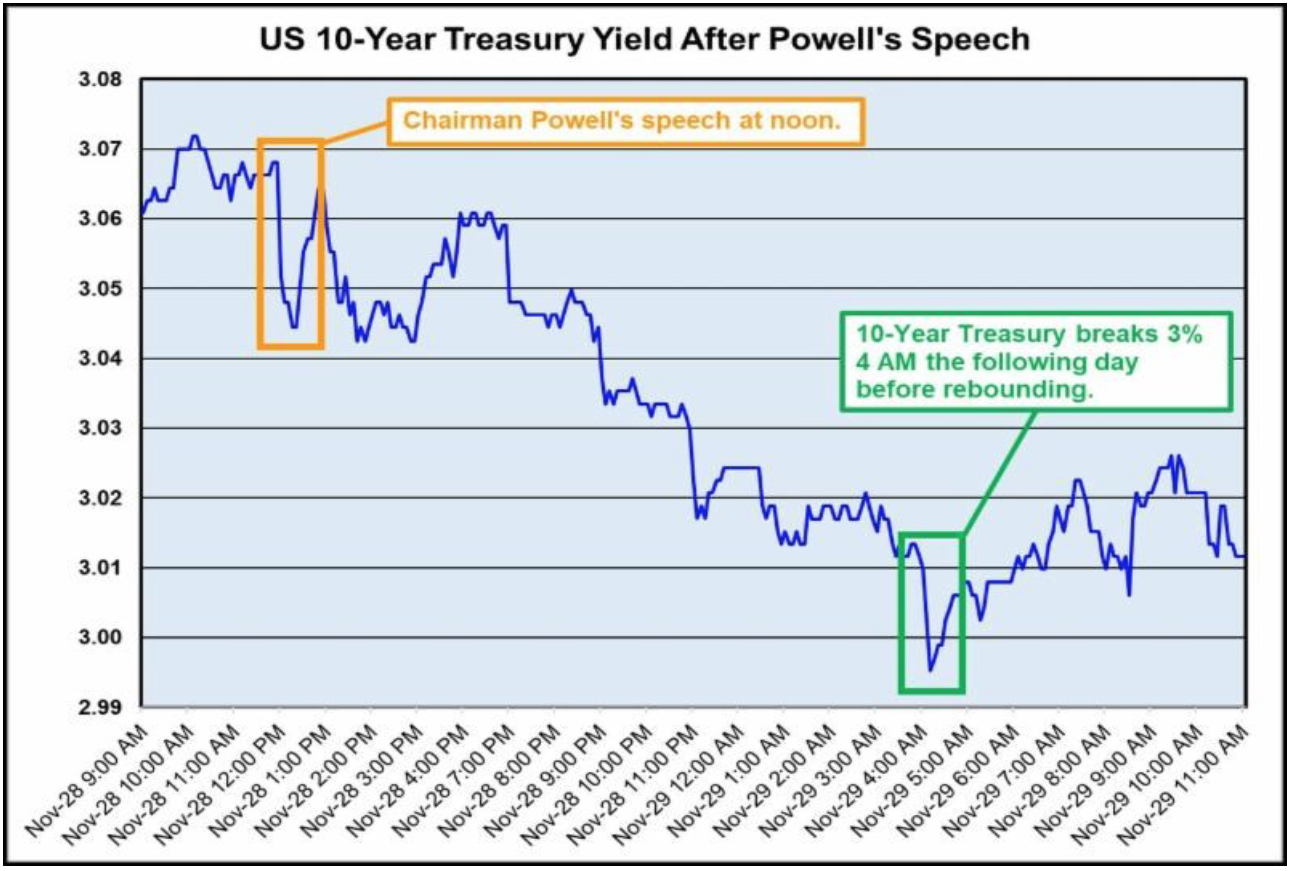

Fixed Income: Treasury yields continued to ease, with the benchmark US 10-Year Treasury Note yield briefly dipping below 3% for the first time since mid-August. High yield bond mutual funds and ETFs reported significant outflows of $1.2 billion in the weekly period ended November 28th.

Commodities: Oil prices were choppy in weekly trading, ending higher after the prior week’s decline saw US West Texas Intermediate (WTI) threatening to break below $50. WTI Prices did slip below $50 a barrel midweek but recovered after Russia signaled a willingness to cooperate with OPEC cuts. WTI ended the week around $51.23, while international benchmark Brent Crude was trading around $58.77 as of Friday afternoon. Natural gas prices shot up midweek then eased to end the week at $4.51/MMBtu.

WEEKLY ECONOMIC SUMMARY

Powell says the magic words: Two words from Fed Chairman Jerome Powell were all it took to send global markets skyrocketing higher. In his Wednesday speech, Chairman Powell described rates as “just below” the neutral level that would prompt the Fed to pause with further hikes. This was a distinct shift from his October comments which categorized rates as a “long way” from neutral. Federal Funds futures markets immediately keyed in on the shift, and expectations adjusted to price in just one rate hike in 2019. It remains a near-certainty that the Fed will continue with a December rate increase.

GDP unchanged at 3.5%: Third Quarter GDP was unrevised at 3.5%, but the underlying data revealed less household and government spending, offset by business investment that was higher than originally reported. Inflation remained unchanged at 1.7%.

3rd Quarter Earnings: Earnings season is just about wrapped up with the last results trickling in. Construction and farm equipment maker Deere (DE) delivered mixed results with a 46% boost in profits but earnings which fell short of projections. Apparel retailer Abercrombie & Fitch (ANF) reported surprisingly strong earnings, sending shares soaring more than 20% With over 97% of the S&P 500 having reported Q3 earnings, the forward price to earnings (P/E) ratios based on full-year 2019 expected earnings are 10.5 for Emerging Markets (MSCI EM IMI), 12.33 for Developed International (MSCI EAFE), and 17.1 for the S&P 500.

Current Model Allocations

Summary

In utilizing an approach that seeks to limit volatility, it is important to keep perspective of the activity in multiple asset classes. We seek to achieve superior risk-adjusted returns over a full market cycle to a traditional 60% equities / 40% bonds asset allocation. We do this by implementing global mandates of several tactical managers with-in different risk buckets. For those investors who are unwilling to stomach anything more than minimal downside risk, our goal is to provide a satisfying return over a full market cycle compared to the Barclays Aggregate Bond Index. At Horter Investment Management we realize how confusing the financial markets can be. It is important to keep our clients up to date on what it all means, especially with how it relates to our private wealth managers and their mod-els. We are now in year nine of the most recent bull market, one of

the longest bull markets in U.S. history. At this late stage of the mar-ket cycle, it is extremely common for hedged managers to underperform, as they are seeking to limit risk. While none of us know when a market correction will come, even though the movement and volatility sure are starting to act like a correction, our managers have been hired based on our belief that they can accomplish a satisfying return over a full market cycle, — while limiting risk in comparison to a traditional asset allocation approach. At Horter we continue to monitor all of the markets and how our managers are actively man-aging their portfolios. We remind you there are opportunities to consider with all of our managers. Hopefully this recent market commentary is helpful and thanks for your continued trust and loyalty.