Stimulus Push Benefits Risk Markets Early.

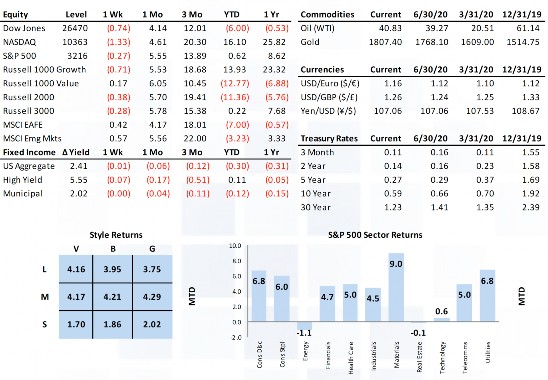

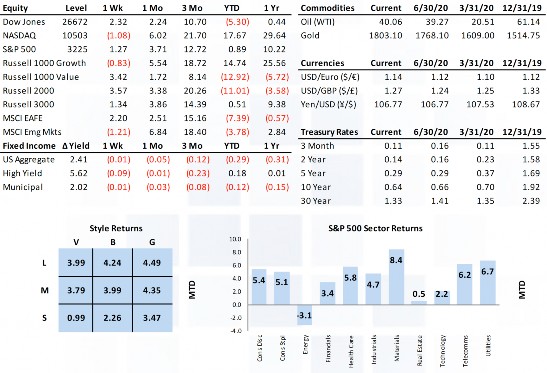

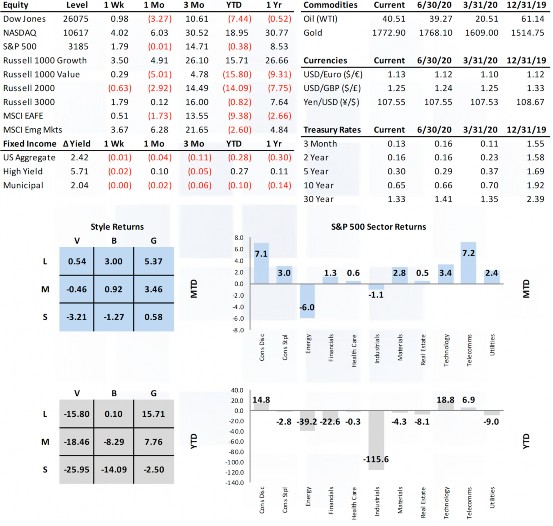

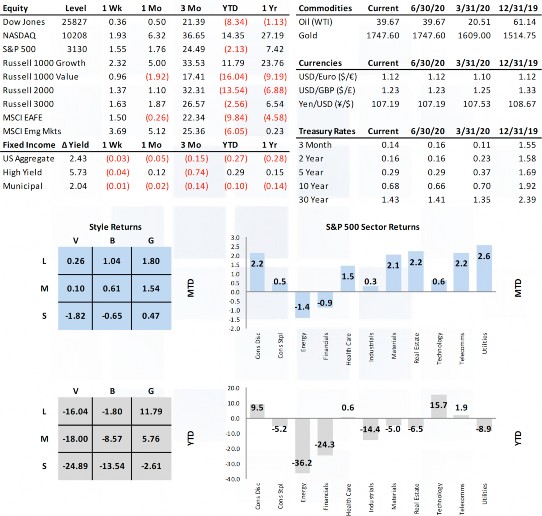

Risk markets benefited early in the week from another stimulus push. Encouraging reports on three potential coronavirus vaccines resulting in the S&P 500 marking a new post-CoVid-19 high but ended up limping into the weekend on concerns surrounding stimulus negotiations in DC and some unfavorable earnings from several technology names. Tech and communication services (FB, GOOG, NFLX) were particularly soft last week while cyclical sectors posted healthy gains. Commodities posted gains as oil moved over $41 while the USD and interest rates moved lower.

Market Anecdotes

• FactSet’s blended 2Q S&P 500 earnings growth rate stands at -42% and revenue growth of -10.1%. Beat rates and forward guidance (spread of +10%) have also been encouraging.

• Last week saw an interesting and forceful rotation in market internals as Tues/Wed/Thurs was the largest 3-day outperformance for value over growth since May of 2001.

• A primary driver of risk markets early last week were positive developments from an extended EU summit resulting in a €1.8 trillion stimulus package.

• Another interesting market internal last week were clear signs of healthy market breadth despite the decline in the headline indices.

• CDS saw a 1 standard deviation move in credit spreads in both Europe and the U.S., confirming stock market behavior early in the week.

• Silver jumped 17% last week alone, buoyed by the weak USD and increasing industrial demand expectations resulting from the global economic recovery.

• Vaccines under development from Oxford, Astra-Zeneca, Pfizer, and BioNTech, and CanSino Biologics all reported encouraging results (responses) in limited human trials.

• An outlook for a structurally weak USD and emergence of cyclical leadership globally make a case for overweight international equities over U.S. equities over a 12-36 month timeframe.

• Bespoke made note of some encouraging observations from the Atlanta Fed’s weekly update of business applications which have been rising rapidly in sympathy with the CoVid-19 recovery.

Economic Release Highlights

• June existing home sales of 4.72mm (+21% MoM) showed improvement and was in line with expectations. New home sales figures were very impressive and crushed expectations.

• Markit flash PMIs (C, M, S) in the U.S. (50, 51.3, 49.6), EZ (54.8, 51.1, 55.1), and Japan (43.9, 42.6, 45.2) have shown clear improvement and are in or drawing closer to expansionary readings.

• Weekly jobless claims of 1.416mm rose WoW for the first time since March and came in higher than expectations. Continuing claims dropped for a seventh consecutive week, by over 1mm, to 16.197mm.

• The weekly AAII Bull-Bear spread remained in negative territory (-20.7%) for a 22nd consecutive week, now tied for the longest net negative reading on record.

W E E K E N D I N G 7 / 2 4 / 2 0

INSIGHT

MARKET ANALYSIS